IBSC M&A

Specialized in Acquiring and Selling IT companies in Europe

- A wide portfolio of companies interested in Selling.

and...

WHY DID I CREATE IBSC M&A?

The idea

IBSC M&A, (with fiscal name Iberian-Scandinavian M&A S.L.) has evolved from my first-hand experience as founder, member of the board and CEO during the last 23 years of a Pan-European IT distributor, with subsidiaries in 26 European countries, and a very clear strategy of using acquisitions as a tool for accelerated growth. We made 44 acquisitions in the last 15 years.

I could visualize an interesting business opportunity for a M&A consultancy specializing in IT companies within Europe offering both Buyers and Sellers an easy access to find a good match. With one common data base of companies in Europe, interested in selling (Sellers) and buying (Buyers), IBSC M&A makes it quite easy for our customers to find the ideal match. We are innovators and to date are unique in offering such powerful and effective M&A tools.

IBSC M&A OFTEN represents the Buyer

IBSC M&A often represents the Buyer. We constantly screen the market in Europe, so our comprehensive database of Targets of Sellers – and Buyers – grows constantly. With our ample acquisition background, we have the experience to negotiate and to build up a business case from the Buyers point of view. A typical business case will include transaction price, deal structure, cost and sales synergies and restructuring costs. With this analysis in place, it is easy to clarify and explain to our customer (the Buyer), the return on investment (ROI) of the operation. On a regular basis we present relevant Sales Targets to our customers as part of our encompassing service commitment. This in turn serves our company well, as we enjoy many recurring customers.

Think different

Having participated directly in identifying and evaluating possible candidates; initiating and managing the initial meetings plus negotiations, due diligences, design of contracts and closings have given us a total vision and know-how of newer, alternative and more creative formulas which finally lead to reaching an agreement. Where more traditional formulas had previously failed, I now see significantly higher than average closing success rates.

From theory to practice

Locating, negotiating, closing, leading and doing the actual physical Integration Post-Merger for a considerable number of acquisitions of companies, has provided us with incalculable experience and expertise in how to assure smooth and efficient mergers and acquisitions.

Problems in the post-merger integrations phase

Most people have heard about mergers and acquisitions, that did not turn out as planned. Actually, in average 70% of all acquisitions fail to create shareholder value. All the nice Excel sheets and PowerPoints crafted through the due diligence showed something very different from the final outcome after the merger of the two organizations. There are many potential factors which could be the cause, such as the inability of efficiently consolidating databases, pricing policies, customer conditions, contracts and vendors relations, mapping of products, integration of ERP systems, communication services, web, etc. Over half of all acquisitions, that do not live up to expectations, are due to problems in the Post-Merger Integration phase.

The human resource challenge

However, often the most difficult task is to facilitate the process of bringing personnel with different company cultures and different work methods from two different teams together in a short period of time, to make them work as one single homogenous team with a united spirit that pursues the same objectives. Therefore, at IBSC M&A, we offer not only counselling regarding human resources, we take it a step further by offering hands on and physically presence to help during the integration phase, to assure a smooth and efficient merger without problems.

It is easier if you know the culture

Having lived and studied in Copenhagen until the age of 25, combined with having worked in Spain as CEO for a Pan European IT Distributor with branches in 26 European countries for 23 years, has given me a wide knowledge of the different European cultures and the IT sector; essential factors for negotiations and being able to close deals. This, together with my extensive network of independent M&A boutiques and private equity funds in Spain and the rest of Europe, offers many unique and interesting cross-border opportunities.

Miguel Cervera Andersen

CEO

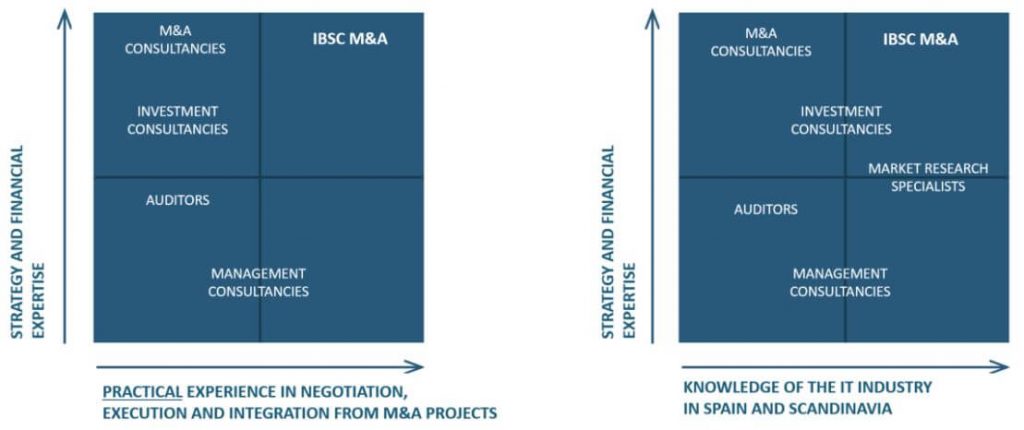

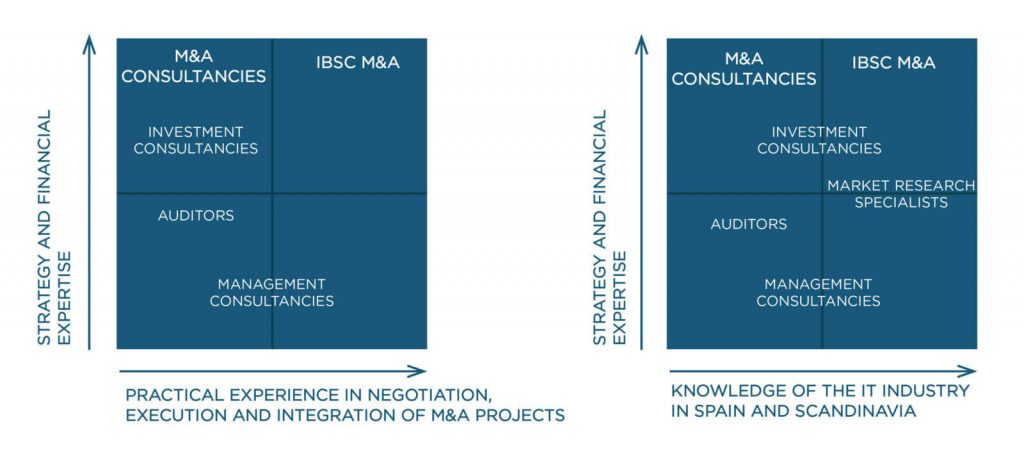

MARKET POSITIONING

WHAT WE DO

IBSC M&A is specialized in bringing Buyers and Sellers together in the IT sector within the Europe.

We continuously screen the European IT market for interested Sellers (and Buyers) developing a large and exclusive data base of IT companies interested in selling or buying – often both. Of significant importance is the exponential possibilities we offer of match between buyer and sellers as our database expands. the possibilities of making a match between a Buyer and a Seller increases exponentially with the size of our data base.

If you are thinking of acquiring an IT company in EU, it is highly probable that we already have suitable Sales Targets for you.

If you are looking at selling or merging your company, it is very probable that we already have agreements in place with interested Buyers.

The match – partnerships – are created through mergers, acquisitions, or capital injections. Mergers and acquisitions can represent an excellent opportunity for accelerated growth and can be key to achieving a defined strategy which ensures future success, especially as medium/large companies tend to dominate more and more.

M&A also represent an excellent way to ensure growth and continuity for small and medium-sized companies. As part of larger businesses, these companies can benefit from economies of scale and financial strength which were previously unavailable to them.

KEYWORDS FOR IBSC M&A

We believe in plain honest talk, direct transparent communication and striping away complexity whenever possible.

- Integrity

- Simplicity

- Transparency

- Integrity

- Simplicity

- Transparency

Find your Match

We bring Buyers and Sellers together using a number of key channels. These include our own large database of Sellers and Buyers, private networks of active relations alongside an international network of independent M&A boutiques and private equity funds.

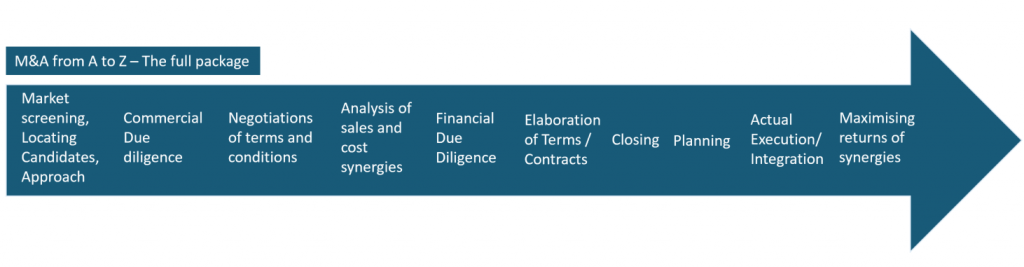

M&A from Start to End

In addition, IBSC M&A does not limit itself to provide consultancy and guidance only until the signing of the deal, but also offers hands-on support, advice and physical involvement in the execution of the subsequent integration and merger.

Avoid mistakes

Many mergers and acquisitions, whose original project was well thought out, falter after signing due to lack of experience in the subsequent phase of execution and integration. An important part of the expected synergies never materializes, as they have been diluted due to failure of being able to bring together the two organizations to work as one, within a tight time frame.

The most significant challenges faced, are consolidation of databases, pricing policy, customer conditions, contracts and relations to vendors, mapping of products, integration of ERP systems, communications, web, plus other factors. However, the most important and often ignored factor is the capability to merge two teams into one single homogenous one that pursues the same objectives.

Efficiency

Locating, negotiating, closing, leading and doing the actual physical integration for a considerable number of acquisitions, has brought valuable experience and expertise in how to assure smooth and efficient mergers and acquisitions and avoid mistakes.

Simplicity

At IBSC M&A Integrity, Transparency and Simplicity are fundamental values. As trust is essential in order to reach agreements and close deals, we believe in plain honest talk, direct transparent communication and striping away complexity whenever possible.

M&A TRANSACTIONS SELECTION

2024 ➡️ Aledit Professional Services, S.L. acquires Soluciones IT Xipset, S.L.

IBSC M&A represented the acquirer, Aledit Professional Services, S.L.

About Aledit: Specialist in IT Services and IT Consulting, programming and digital transformation in general. Founded in 2017 and with headquarters in Madrid – Spain.

2023 ➡️ PC Componentes (YF Networks Group) acquires Atlas InformáticaS.L.

IBSC M&A represented the Buyer, PC Componentes.

About PC Componentes: E-Tailer specialized in technology, leader in Spain with a turnover around than 500 million euros and more than 600 employees.

2023 ➡️ EET Group acquires Nauta - Soluções de Segurança, Lda.

IBSC M&A represented the acquirer, EET Group

About EET Group: EET Group is one of the largest distributors in Europe within our field, operating in 24 markets, serving more than 30.000 annual buying costumers and carrying more than 1.100 brands. This has been achieved through strong organic growth and a very successful acquisitions strategy, resulting in 51 acquisitions from 1998 till 2023. This was the third acquisition in 2023.

2022 ➡️ Valsoft Corporation Inc. acquire T-Innova S.A.

IBSC M&A represented the Seller, T-Innova S.A.

About Valsoft Corporation: Valsoft, a Montreal-based company acquires and develops vertical market software companies, enabling each business to deliver the best mission-critical solutions for customers in their respective industries or niche.

2022 ➡️ EET acquires Avant Video Technology S.L.

IBSC M&A represented the acquirer, EET Group

About EET Group: EET Group is one of the largest distributors in Europe within our field, operating in 24 markets, serving more than 30.000 annual buying costumers and carrying more than 1.100 brands. This has been achieved through strong organic growth and a very successful acquisitions strategy, delivering 48 acquisitions from 1998 till 2021.

2022 ➡️ EET acquires CCTV Center S.A.

IBSC M&A represented the acquirer, EET Group

About EET Group: EET Group is one of the largest distributors in Europe within our field, operating in 24 markets, serving more than 30.000 annual buying costumers and carrying more than 1.100 brands. This has been achieved through strong organic growth and a very successful acquisitions strategy, delivering 48 acquisitions from 1998 till 2021.

2021 ➡️ Zaltor S.A. acquires Optima IT S.L.

IBSC M&A represented the acquirer, Zaltor S.A.

About Zaltor S.A.: Leading wholesaler in software, cybersecurity, MSP and cloud.

2020 ➡️ EET acquires Express Parts S.L.

IBSC M&A represented the acquirer, EET Group

About EET Group: EET Group is one of the largest distributors in Europe within our field, operating in 24 markets, serving more than 30.000 annual buying costumers and carrying more than 1.100 brands. This has been achieved through strong organic growth and a very successful acquisitions strategy, delivering 48 acquisitions from 1998 till 2021.

SALES TARGETS

Here you will find a list of IT companies in Europe that are interested in selling or merging.

With most Sales Targets, the Databook, HR data and financial statements are available and a Commercial Due Diligence (CDD) report has been developed.

Do you want to sell your company?

If you are considering selling your company or merging with a larger one, IBSC M&A offers you free access to a large number of companies within your country, and outside, looking for acquiring opportunities. We probably already have an interested Buyer in our data base for you.

You avoid the expense of having to hire a M&A consultancy to sell your company. Remember, all IBSC´s fees are paid by the Buyer. You also avoid, rumours reaching the market or your employees about your desire to sell. IBSC M&A will only offer your company to one Buyer at a time, which we know in advance will be interested and will make a good fit for you. We will not make a Teaser and send it out to several Buyers in one go.

Due to the methodologies we employ, companies that already have had several unsuccessful M&A attempts, with the help of IBSC M&A, often manage to close a deal.

Finally, important and often ignored, hopefully this way all the hard work, tons of dedication and devotion, you probably have employed into the company over the last many years, somehow carries on in the future.

Knowledge

Deep knowledge of Spanish and Scandinavian culture and IT sectors.

M&A Specialists

Extensive experience in M&A, implementation of synergies, strategies and optimization.

Creativity

Knowledge of creative and effective formulas, often unknown in the market, assure that a high percentage of deals are closed.

Smooth merging

Extensive practical experience, hands-on and management, in the process after closing when the execution, merger and integration begin.

Experience

Having lived and studied in Copenhagen until the age of 25, combined with having worked in Spain as CEO for a Pan European IT Distributor with branches in 26 European countries for 23 years, has given me a wide knowledge of the different European cultures and the IT sector; essential factors for negotiations and being able to close deals. An important part of our Group´s clear and well-designed strategy was the growth through centralization, optimization and acquisitions. During the last 15 years, the 44 purchases, both Scale and Scope acquisitions, were essential for the Groups growth far higher than average in the market.

Our own database

Qualified private database of potential partners plus an international network of independent M&A boutiques and private equity funds.

Legal expertise

Considerable expertise in negotiation, purchase and sale contracts, legal, labour and fiscal issues.

Proven success

Locating, negotiating, closing, leading and doing the actual physical integration for a considerable number of acquisitions of companies, has brought valuable experience and expertise in how to assure smooth and efficient mergers and acquisitions and avoid mistakes.

YOU WANT TO ACQUIRE

WHY ACQUIRE OR MERGE?

Mergers and acquisitions can represent an excellent opportunity for accelerated growth and can be the key to achieving a defined strategy which ensures future success in particular as medium/large companies tend to dominate more and more.

LARGE DATA BASE OF COMPANIES INTERESTED IN SELLING

IBSC M&A continuously screen the European IT market for interested Sellers (and Buyers) building up a large data base of IT companies interested in selling or buying – often in both. And especially important, the possibilities of making a match between a Buyer and a Seller increases exponentially with the size of our data base.

You will continually be presented with relevant Sales Targets within Europe. Our fees are only based on results, no initial fees or retainers are charged – No Cure No Pay.

If needed, IBSC M&A helps you carry out due diligence, analyses of cost/sales synergies and guides negotiations until the deal is completed. The formulas we use to reach agreements are often very different and more creative than the traditional ones currently being applied in the M&A sector.

Due to the methodologies we employ, companies that already have had several unsuccessful M&A attempts, often manage to close a deal with the help of IBSC M&A.

TYPICAL BUYER MISTAKES

Most mergers and acquisitions had the original project well thought out, but fail after Closing due to lack of experience in the Post-Merger integration phase. An important part of the expected synergies never materializes, as they were diluted because the Buyer was unable to merge two organizations together to function as one within a tight time frame.

The most important challenges the Buyer face are database consolidation, pricing policy, customer conditions, contracts and supplier relationships, product mapping, integration of ERP systems, communication services, the web and other factors.

However, the most important and often overlooked factor, is the ability to unite two teams into a single homogeneous team pursuing the same goals.

It is difficult in a short period of time, to bring together people with different business cultures and make them function as one single homogeneous team, with a united spirit that pursues the same objectives.

Therefore, at IBSC M&A, we offer advice and help during the integration phase, to ensure a smooth and efficient fusion without problems.

HOW TO AVOID THESE MISTAKES

IBSC M&A does not limit itself to provide consultancy and guidance only until the signing of the deal, we also offer hands-on support, advice and physical involvement in the execution of the subsequent integration and merger.

Locating, negotiating, closing, leading and doing the actual physical integration for a considerable number of acquisitions of companies with turnovers from 1 to 20 million, has brought very extensive experience and expertise in how to assure smooth and efficient mergers and acquisitions and avoid mistakes.

IBSC Market positioning

CONTACT US

Fill out this form with your personal details and we will get in contact with you soon.

- IBSC M&A

- Iberian Scandinavian M&A S.L.

- VAT: ESB88331673

-

Avd. Bruselas 7 - Planta 2

28109 - La Moraleja, Madrid - +34 669 468 248

- mca@ibscma.es